So what exactly, I wondered, is the Baltic Dry Index? And is it a good thing, or a bad thing, that it is plunging downwards at the fastest rate since records began etc etc?

These turn out to be two good questions.

The Baltic Dry Index (BDI), I discover, measures the freight rates of raw materials around the world. It’s therefore an important measure of material and energy intensity in the global economy.

We hardly ever see bulk carriers like the monster above, or this one below

– still less think about them. And yet we should: Shipping’s CO2 emissions, and energy intensity, are in the same order of magnitude as those of road and rail – which move much smaller cargoes over much shorter distances.

These high levels of resource intensity place a big question mark over the long term viability of bulk trade in food and raw materials.

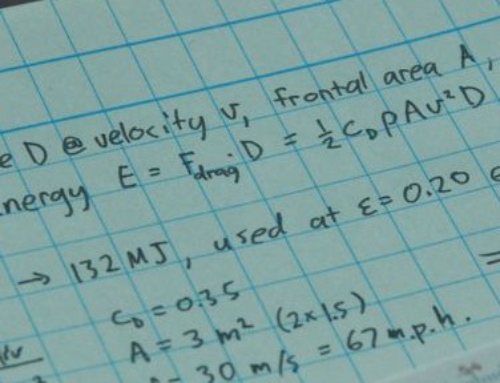

A briefing by Global Dashboard recently commented on the shipping industry’s own numbers including the graphs below.

“One of the bits of data posted ” says GD, “compares the CO2 emissions from moving a ton of cargo 1 kilometre with the emissions that would result from moving it instead by rail, road or air. For shipping, the figure is 12.97 grammes of CO2 – as opposed to 17 grammes for rail, 50 for road and 552 for air.

“Presumably, the shipping companies involved think this constitutes a good argument in shipping’s favour. But in fact, the surprise is that shipping’s emissions are so high relative to the other three transport modes, rather than so low”.

This brings us to the Baltic Dry Index and its impressively plunging graphs….

BDI rates have plunged 50 percent this year – in large part, apparently, because iron ore demand from China is plummeting.

Do we want the Baltic Dry Index to recover and shoot upwards again?

If the Berge Stahl stays dockside, and empty, it’s good for the planet – but bad for the global economy in its present form.

Clear?